Foreign banks are expanding their presence in Vietnam due to the country’s strong economic growth and increasing demand for banking services. The State Bank of Vietnam requires foreign banks to adhere to specific regulations and guidelines to operate in Vietnam. Foreign investors can establish a commercial presence or purchase shares of an existing financial institution in Vietnam. The goal of a new commercial presence is to ensure that these institutions operate in compliance with local laws and regulations, and align with the country’s economic development goals. Understanding these regulations is crucial for foreign banks seeking to establish a successful presence in Vietnam’s rapidly growing market.

Overview of banking sector in Vietnam

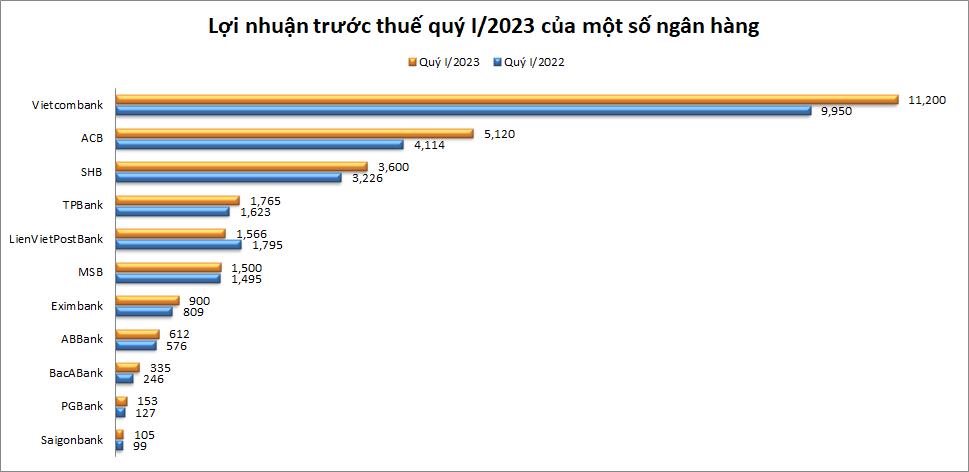

The banking sector observed positive results during the first quarter of 2023. The banking industry gradually revealed a profitable picture during the first quarter of 2023. As of April 23, 14 banks have disclosed their first-quarter business results.

After Vietnam began opening up its banking system in 1990, there has been a surge in the presence of foreign banks in the country. Vietnam’s joining of the WTO in 2007 further accelerated this trend, followed by the completion of integration policies. The major players among foreign banks currently operating in Vietnam include HSBC, Citibank, ANZ, and Shinhan Bank.

When it comes to market entry, foreign banks in Vietnam typically adopt one of four modes. These include setting up a representative office, a branch office, a wholly foreign-owned bank, or a joint venture bank.

Despite the popularity of certain licensing methods in the past, they have been subjected to increased scrutiny and regulation in recent years. However, investors can explore a different approach known as New Forms of Investment (NFI). This method allows for collaboration between a foreign bank and a local partner through a Business Cooperation Contract (BCC) or Strategic Partnership, or participation in an M&A arrangement.

Guidelines on establishment of foreign banks presence in Vietnam

Description:

The most limited form of company setup is the Representative Office (RO) since it cannot engage in revenue-generating activities. As a result, it is typically the least expensive option and often only utilized during the early stages of market entry.

Contrarily, a branch office can offer banking services. Nonetheless, it is heavily reliant on the parent bank for decision-making processes and financial resources. Circular 23/2020/TT-NHNN stipulates many constraints on the activities of foreign bank branches, which are subject to supervision from both the home country and Vietnam.

Wholly foreign-owned and Joint ventures are legally independent of the foreign investor and utilize their capital to conduct business. As a result, foreign banks may be required to invest additional capital if they wish to provide the same level of lending activity through a subsidiary instead of a branch.

Requirements:

Vietnam does not impose any restrictions on setting up a Representative Office (RO) in accordance with its WTO commitments on services. A bank can establish an RO in Vietnam as long as it complies with the legal framework of its home country for conducting overseas operations.

To establish a branch office, the parent bank must maintain total assets of over USD 20 billion in the fiscal year preceding the application for setup. Additionally, the bank must provide a written guarantee to assume all liabilities and obligations of its branch in Vietnam. The minimum charter capital required for a branch is USD 15 million.

When establishing a wholly foreign-owned or joint venture company, the foreign partner will be required to provide a written guarantee to support the financial, technological, administrative, executive, and operational aspects of the company. This written guarantee serves as a commitment to maintaining the required charter capital and complying with safety regulations. Additionally, a collaborative supervision agreement between a foreign government authority and the State Bank of Vietnam (SBV) must be in place to supervise financial institutions’ operations in accordance with international practices.

Guidelines for foreign banks:

In order for foreign banks to establish a successful RO/branch/wholly-owned foreign bank/joint venture in Vietnam, there are typically two main steps they must undertake. The initial step involves obtaining a banking license issued by the SBV, which includes specific procedures outlined in Circular 40/2011/TT-NHNN or through consultation with legal experts. This process can be lengthy and requires compliance with certain conditions, such as charter capital and years of establishment. The license is typically granted within 30-60 days for ROs, while the process for branches and other corporate forms can take up to 242 working days.

After securing the banking license, foreign investors must complete the business registration process to obtain relevant business licenses from either the Department of Industry and Trade (for ROs and branches) or Department of Planning and Investment (for wholly-owned and joint ventures). This procedure typically takes between 30-60 working days, with additional steps required for compulsory seal and tax registrations.

Conclusion

Overall, regulations for foreign banks setting up a presence in Vietnam are designed to ensure that foreign investors comply with the laws and regulations of the country, while also promoting foreign investment in the banking sector. Although the process can be complex and time-consuming, foreign banks that successfully establish a presence in Vietnam can benefit from a dynamic and growing economy, as well as the potential to tap into the country’s large and rapidly expanding consumer market. As Vietnam continues to integrate more deeply into the global economy, it is likely that the regulatory environment for foreign banks will become more streamlined and efficient, making it an even more attractive destination for foreign investors seeking to expand their presence in Southeast Asia.

HMLF is always available to offer assistance in understanding the procedures with authorities.

Harley Miller Law Firm “HMLF”

Head office: 14th floor, HM Town building, 412 Nguyen Thi Minh Khai, Ward 05, District 3, Ho Chi Minh City.

Phone number: +84 937215585

Website: hmlf.vn Email: miller@hmlf.vn